What is investment?

Most of us are like the farmer, spending our whole life slogging away for money and still unable to accumulate the wealth required to retire. While you are working for money, why not put your idling cash sitting in the bank to work for you. That right! I'm talking about investing right now. You could be the gentleman ridding on cash in near future!

An investment is an asset or item that is purchased with the hope it will generate passive income or capital appreciation.

An investment is an asset or item that is purchased with the hope it will generate passive income or capital appreciation.

E.g.

You have bought stock A now for $100. A year later, stock A risen to $150 (Capital appreciation) and you sold off your position to make $50 profit. (Capital gain)

You have bought a bond now for $100. The bond has a coupon rate of 10% annually and you will receive $10 every year until the bond mature. (passive income)

This blog will talk about Savings account, Central Provident Fund (CPF) and Bonds which are considered to be a safer asset class and Stocks and FOREX which are considered to be a riskier asset class. Allow me to cover the steps needed to prepare yourself and to eventually kick-start your investment journey!

You have probably heard of many that are trying to or working towards Financial Freedom. So what the heck is financial freedom? Financial freedom is whereby passive income from your investment exceed your monthly expenses.

E.g.

You have a monthly expense of $1500 a month. Your investment generate monthly return of $2000. Therefore you have achieved financial freedom as you will have $500 extra every month to spend on your wants.

You have bought stock A now for $100. A year later, stock A risen to $150 (Capital appreciation) and you sold off your position to make $50 profit. (Capital gain)

You have bought a bond now for $100. The bond has a coupon rate of 10% annually and you will receive $10 every year until the bond mature. (passive income)

This blog will talk about Savings account, Central Provident Fund (CPF) and Bonds which are considered to be a safer asset class and Stocks and FOREX which are considered to be a riskier asset class. Allow me to cover the steps needed to prepare yourself and to eventually kick-start your investment journey!

What is the ultimate aim of investing?

You have probably heard of many that are trying to or working towards Financial Freedom. So what the heck is financial freedom? Financial freedom is whereby passive income from your investment exceed your monthly expenses.

E.g.

You have a monthly expense of $1500 a month. Your investment generate monthly return of $2000. Therefore you have achieved financial freedom as you will have $500 extra every month to spend on your wants.

Why should you invest now!

To beat inflation

Inflation is define as the increase in general price level of goods & services. Returns from investment is needed to cover the bare minimum of the inflation to ensure current consumption = future consumption.

E.g.

Interest rate: 0.05%

Inflation rate: 3%

Investment returns: 3%

Scenario 1: Assume you leave your savings of $10,000 in bank saving account earning 0.05%. A year later, your saving did increase to $10,005. But taking inflation into account, your savings only worth $9,713.59 ($10,005/103 x 100). This is a loss of $286.41 every year you leave your money in saving account.

Scenario 2: Assume you decided to invest your saving of $10,000 earning 3%. A year later, your saving increased to $10,300. By taking inflation into account, your savings still worth $10,000 ($10,300/103 x 100). Therefore your investment is said to have beat inflation & your are still able to buy the same amount of goods in future as compared to now.

Therefore, is better off leaving your savings in investment as your money in future will still be able to buy the same amount of goods now!

Bank the ultimate winner

By leaving your savings in bank, ultimate loser will be depositors (us) while the ultimate winner will be bank. Bank pay depositors (us) a return of let say 0.05% while bank lend out money to businesses at a rate of let say 4%. Bank will eventually earn a net return of 3.95% and we as depositors earning a meager return of 0.05%. Therefore there is a huge need to park excess cash in investment!

Risk, returns & time horizon

Starting investment early allows you to generally take more risk as your investment period is longer thus higher returns.

For E.g.

Scenario 1: A person started at age 22

Considering an individual that is of rather a young age of 22, there would not be much financial burden on the person. Let's presume the worst case scenario, where the individual has lost all his investments, he is still able to work to build back his investment fund over time. Furthermore with a longer time horizon, he is able to allocate his assets toward aggressive growth with majority percentage of assets in riskier asset class such as stocks that will provide a higher returns. If successful, the person will be able to build up a strong portfolio providing substantial passive income to achieve financial freedom.

Scenario 2: A person started investing at age 40

Considering an individual that is reaching near his or her 40s, there will be substantial financial burdens on hand such as home mortgage, family expenses, retiring funds, etc. Let's say the worst case scenario is that the person loses all his investments, he is only able to work for another few more years and with his current financial burdens, it will prevent him from building back the investment fund. Furthermore with a shorter time horizon, he is only able to allocate his assets toward a conservative manner with majority percentage of assets in safer asset class such bonds that will provide a lower returns. If successful, the person can only build up a weak portfolio providing minimal passive income and may have problem to achieve financial freedom.

In short, you are better off if you start investing earlier with a greater time buffer for your investment to grow!

Time value of money

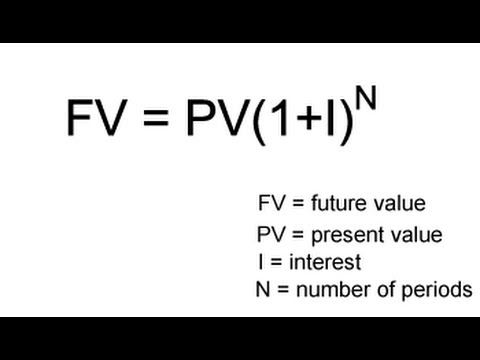

Taking in consideration that you will reinvest your money from capital appreciation and passive income. We will use the above compounding formula to calculate the final sum received at the end of investment.

E.g.

Assume investment annual return of 5% and investment horizon up to age 55.

Scenario 1: Started investing $10,000 at age 25.

Accumulated amount at age 55: $10,000 x (1+0.05)^30= $43,219.42

Scenario 2: Started investing $10,000 at age 35.

Accumulated amount at age 55: $10,000 x (1+0.05)^20= $26,532.98

Comparing the 2 scenarios, starting investing 10 years earlier will enable you to have $16686.44 more in your final accumulated value.

Comparing the 2 scenarios, starting investing 10 years earlier will enable you to have $16686.44 more in your final accumulated value.

The above scenarios might not be accurate to depict real life scenario as you may not just invest a fixed amount of money at the start and not adding more in future.

Therefore to paint a more realistic scenario, we will use the above formula to compute the final accumulated value at the end of the investment.

E.g.

Assume investment annual return of 5% and investment horizon up to age 55.

Scenario 1: Started investing $1,000 every end of year at age 25.

Accumulated amount at age 55: $1,000 x [((1+0.05)^30-1)/0.05]= $66438.85

Scenario 2: Started investing $1,000 at age 35.

Accumulated amount at age 55: $1,000 x [((1+0.05)^20-1)/0.05]= $33065.95

Comparing the 2 scenarios, starting investing 10 years earlier will enable you to have $33372.90 more in your final accumulated value.

In short, the earlier you start investing, the power of compounding take its effect and thus result in a higher final accumulated value!

Comparing the 2 scenarios, starting investing 10 years earlier will enable you to have $33372.90 more in your final accumulated value.

In short, the earlier you start investing, the power of compounding take its effect and thus result in a higher final accumulated value!